Why Billionaire Warren Buffett Gives Mortgages a Thumbs Up

Warren Buffet describes the 30-year-mortgage as “the best instrument in the world.” He is one of the wealthiest and most successful investors in the U.S., yet he surprisingly took out a mortgage himself when purchasing a vacation home in 1971. When CNBC asked him why, he replied, “I thought I could probably do better with the money than have it be an all-equity purchase of the house.” He certainly did. Buffet used proceeds from the loan to invest in Berkshire stock that grew to an estimated $750 million.

While that is an extreme case of what is possible, it is still true that a good mortgage strategy is one of the best ways to create lasting wealth. Here are a few other reasons why “The Oracle of Omaha” says a mortgage is one of the best investments you can make.

Build Your Net Worth

A home is the single largest purchase many will make in their life. It should not be viewed solely as a cost however, as Warren Buffet says, “A home should be the greatest asset for most people.”

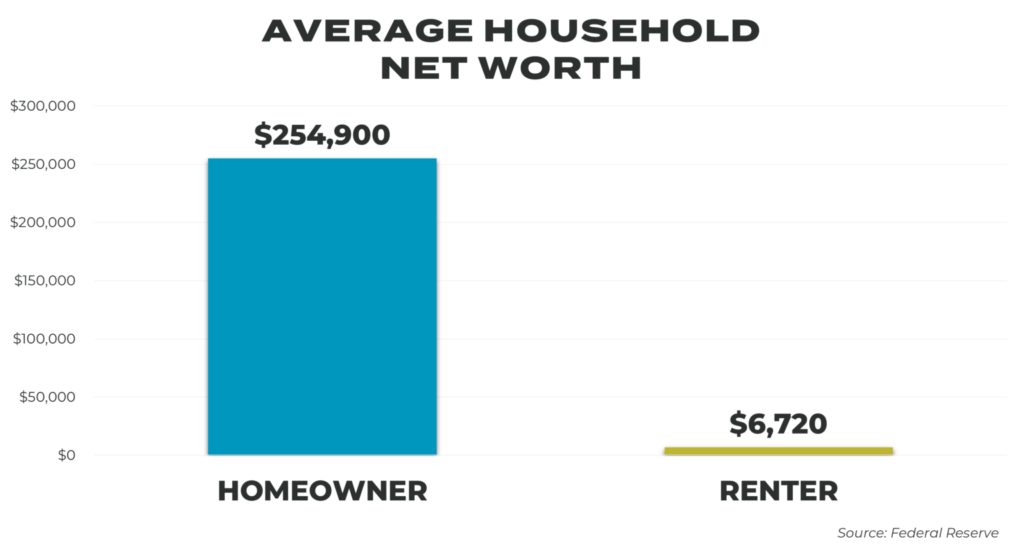

Homes are an incredible way to build wealth and invest in your future. Nowhere is this more evident than the difference in net worth between renters and owners. The Federal Reserve documents this by creating the Survey of Consumer Finances every three years and the results are shown in the chart below.

Their most recent data from 2019 shows that the average homeowner’s net worth is over 40 times greater than that of the average renter. Both renters and homeowners are paying monthly fees to live somewhere, but owning a home is one of the best ways to increase your net worth and gain financial security.

Benefit From Home Price Appreciation and Build Equity

Home equity is the difference in the amount of loan you owe compared to how much your home is now valued at. When home prices go up, existing homeowners increase their equity by simply making their monthly payments.

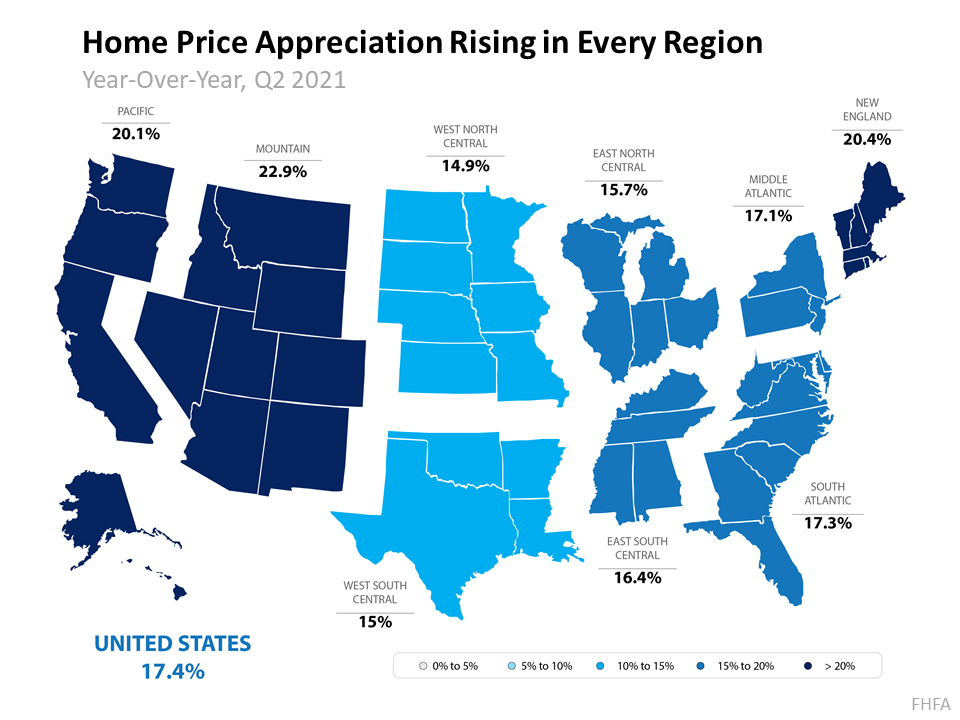

Warren Buffet’s vacation home sold for over 50 times more than what he bought it for. He purchased his Laguna Beach, California vacation home for around $150,000 in 1971 and sold it in 2017 for $7.9 million. Although that payoff was a long time in the making, last year alone home prices appreciated by at least 14.9% as reported by the Federal Housing Finance Agency, some regions were even higher as shown below.

This home price appreciation led to larger than ever home equity gains. Corelogic reports that since this time last year the average homeowner has gained $51,500 in equity.

The sooner you buy, the sooner you can start building your equity. Your equity can eventually be used to help you pay off your non-mortgage debts, fund an education, or move to a new location.

Bottom Line

With one of the wealthiest people in the United States applauding mortgages as one of the best investments you can make, it’s time to see why for yourself. The multi-billionaire says another thing that makes a mortgage so appealing is your ability to get a lower payment in the future,

“If you get a 30-year mortgage it’s the best instrument in the world, because if you’re wrong and rates go to 2 percent, which I don’t think they will, you pay it off,” Buffett said. “It’s a one-way renegotiation. I mean it is an incredibly attractive instrument for the homeowner and you’ve got a one-way bet.”

Ready to start building wealth, equity, and financial security? Find an Art of Homeownership professional near you to schedule a no-obligation consultation to look at the options you have with homeownership.

SUBMIT YOUR COMMENT